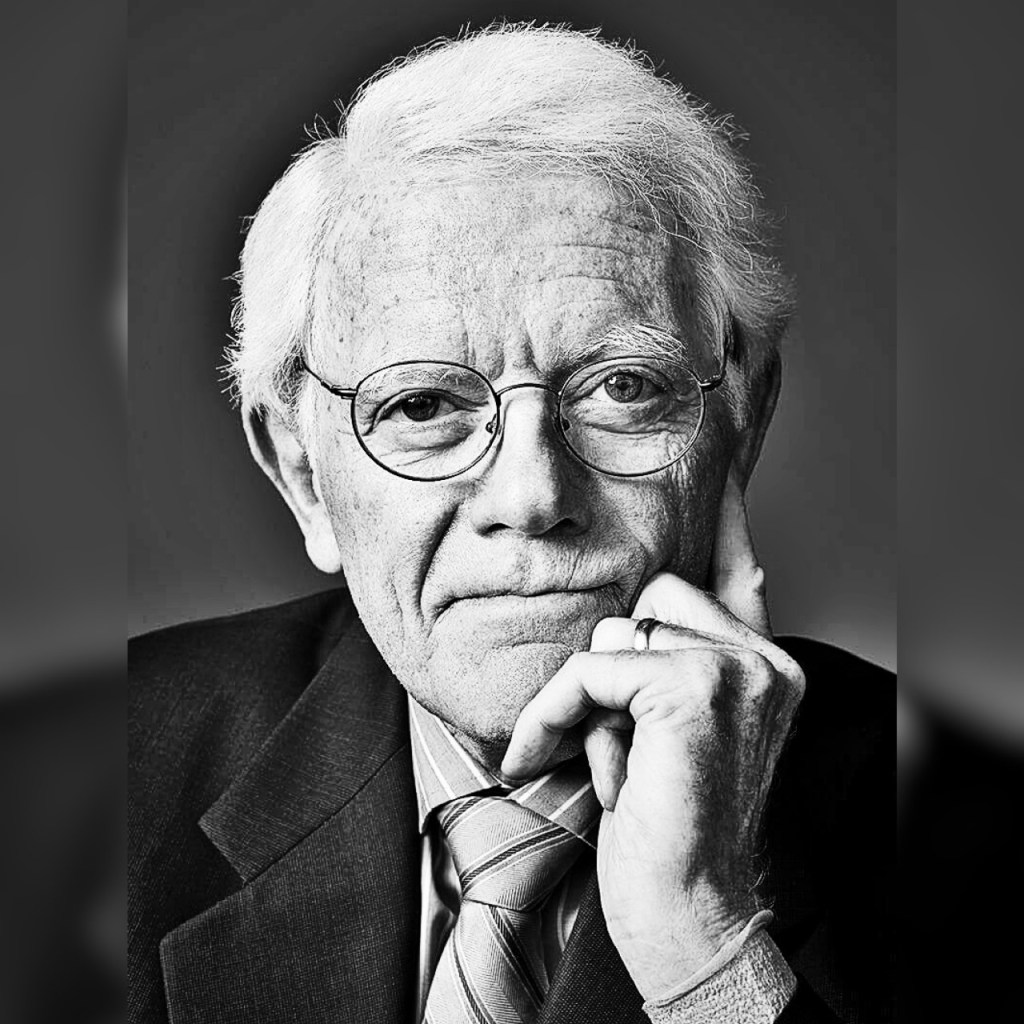

Some moments in life redefine the way we think, approach challenges, and make decisions. For me, watching Peter Lynch’s 1994 speech was one such transformational experience. It wasn’t just an eye-opener—it reshaped my investing psychology entirely. This speech, in my opinion, is one of the finest ever delivered on investing principles. I encourage everyone to watch it at least once. Here, I’ll share some of the most profound lessons I learned from it.

Keep It Simple, Know What You Own

Peter Lynch is celebrated as one of the greatest investors, not for making things complex but for keeping them simple. He emphasized the importance of understanding what you own. Lynch shared examples of some of his most successful investments—Dunkin’ Donuts and Stop & Shop. These are straightforward businesses that anyone can comprehend.

Yet, we often dismiss such simple businesses, assuming they can’t generate significant wealth. But ask yourself: How can I own a business I don’t understand? The truth is, simplicity doesn’t limit potential—it magnifies it when paired with clarity and conviction.

Forget Predicting the Markets, Interest Rates, or Economy

Lynch debunked one of the biggest myths in investing: the belief that we can predict markets, interest rates, or the economy with precision. Analysts and economists might argue otherwise, but the reality is that trying to foresee every macroeconomic movement is a futile exercise.

There are simply too many variables at play, most of which are beyond anyone’s control. If it were possible to predict GDP growth, money supply, or interest rates with accuracy, wouldn’t all economists be billionaires by now? Instead, Lynch teaches us to focus on what we can understand—business fundamentals and long-term value.

The “How Much Lower Can It Go?” Fallacy

How often have you bought a stock thinking it couldn’t fall any further, only to watch it drop even more? It’s a common trap we investors fall into. We fixate on price instead of value.

Lynch reminds us that price alone doesn’t tell the whole story. What truly matters is whether the stock has value at its current price. If you understand a company’s story—its business model, growth potential, and intrinsic worth—investing becomes far simpler and far more rewarding.

Regret Over Missed Opportunities

With over 2,500 stocks listed on the NSE, it’s impossible to know and analyze every company. As investors, we often dwell on missed opportunities—those multibagger stocks we never bought. But here’s the truth: there will always be great companies we’ll never own, and that’s okay.

The key is to focus on identifying good businesses that we can understand, invest in them, and hold on as long as they remain fundamentally strong. Remember, you don’t need to own every great stock to achieve success in investing.

Beware of the “Next Big Thing”

We’re constantly bombarded with hype around potential multibaggers—companies touted to revolutionize their industries and deliver 10x or even 50x returns. These “future giants” often have low revenue, weak fundamentals, or are deep in losses. Yet, we feel compelled to jump in, fearing we might miss out.

Lynch’s advice? Patience. Great investments don’t happen overnight. Successful investors understand the power of holding strong, proven businesses and resisting the urge to chase speculative bets.

Sensible Investing: The Ultimate Goal

As investors, we often complicate things unnecessarily. We stray from the basics and get caught up in noise and hype. But legends like Peter Lynch teach us to return to the fundamentals: keep things simple, focus on what you understand, and invest with conviction.

Peter Lynch’s 1997 speech isn’t just an investing lesson—it’s a philosophy for life. I cannot recommend it enough. Watch it, absorb its wisdom, and see how it can change your perspective, just as it did for me.

Leave a comment